1C: Enterprise 8.2 /

Accounting for Ukraine /

Accounting

Table of contents

The document "Admission of additional. expenses "(menu" Purchase - "Receipt of additional expenses") is intended to reflect the additional expenses that are transferred to the cost of purchased goods and materials.

Usually, the supplier in the case of delivery of the goods writes out one expenditure invoice, which indicates the cost of goods and materials sold and the cost of their delivery. This information in the program should be designated by two different documents. The first of which " Receipt of goods and services "→ capitalization of purchased goods and materials, and the second document," The receipt of add. Expenses ”displays information on delivery and distributes the cost of this service to the initial cost of acquired values.

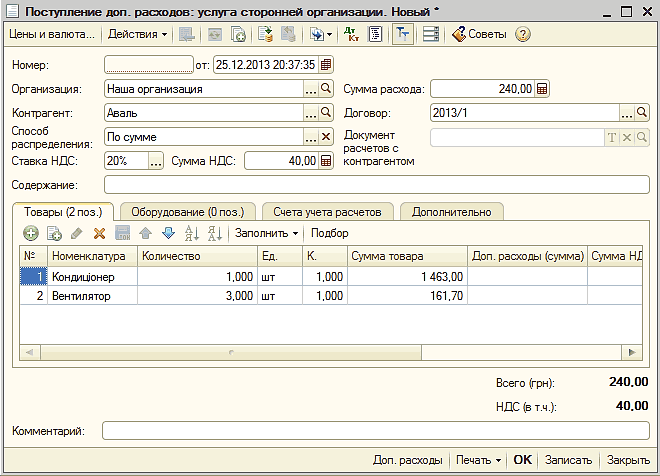

In the header of the document “Admission additional. expenses ”, the following details are recorded: the name of the counterparty, the contract, the VAT rate, the amount of expenses, and the method of distribution. To save time and simplify fill out the document , it is necessary to enter “Admission of add. expenses ”in accordance with the document“ Receipt of goods and services ”, which were credited with the goods and materials. To do this, use the "Fill" button. It provides two options:

· “ Fill in on admission »Fills in the tabular part according to the selected admission document;

· “ Add from receipt »Is chosen in the case when the tabular part of the document requires filling in according to several receipt documents.

Ultimately, most of the details in the header of this document will be already filled, and the tabular part will be filled automatically. It remains only to indicate the amount to be distributed in the line “Amount of expenditure”.

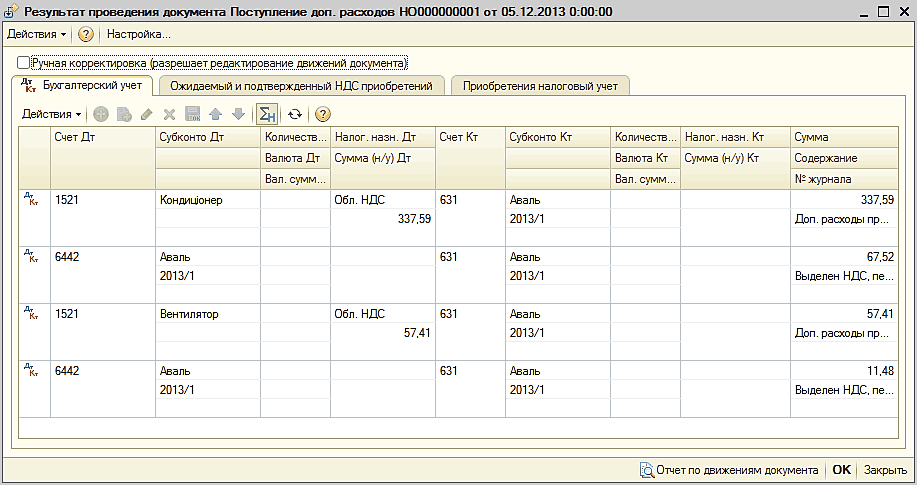

The document "Admission additional. expenses ”are independently allocated the amount of additional expenses on the initial cost of the purchased goods and materials. From the distribution option selected in the “Distribution method” field it will depend on how exactly the expenses will be distributed. Additional costs will be allocated to the cost of goods in proportion to their value in the method of distribution "by amount". And with the method, which is called “by quantity”, expenses will be distributed in direct proportion to the quantity of goods purchased.

At the same time, in the tabular part of this document in the “Add. expenses (amount) ”you can specify the amount of other additional expenses for a particular item of the goods. How will the cost of goods be calculated in this case? The value of the goods will be added to the amount of automatically distributed additional costs and the amount of those costs that are specified manually in the column “Add. expenses (amount). "

Other materials on the topic:

add from receipt , fill in upon receipt , receipt of additional expenses , amount of expenditure , additional expenses , cost of goods , service , distribution method , receipt additional. expenses , tabular part , title , costs , goods , cost price , receipt of goods , receipt of goods and services , the cost , result , arrival , services , product , the sum , organization , organizations , of the document , document

Materials from the section: 1C: Enterprise 8.2 / Accounting for Ukraine / Accounting

Other materials on the topic:

If there were transportation and other expenses

Purchase of inventory

Work with documents

Features reflect the additional costs in management accounting

System-wide mechanisms and principles

We find: distribution method by amount or by quantity , distribution of additional expenses by amount or by quantity , how to distribute additional expenses by amount or by amount in 1c8, how to distribute additional expenses in 1 s, how to distribute additional expenses by amount or by quantity? how to allocate additional expenses, how to properly allocate additional expenses by amount, how to reflect in 2CS 2 additional services for the delivery of materials, additional expenses, distribution, how expenses are distributed by amount or quantity

How will the cost of goods be calculated in this case?

How will the cost of goods be calculated in this case?